For SaaS Startup Success, Plan For 10 Years And More

If you’re building a startup, plan as you would a marathon over decades, and grow your team culture and skills accordingly on this time frame.

By Evan Tan I work at a SaaS data analytics startup called Holistics Software, taking on established brand names in the business intelligence space like Tableau and Looker. We were founded in 2015, and have been profitable with 100+ customers in over 20 countries. Being on this side of the fence of a startup and joining the team as employee number 10, I find myself thinking lots about what it means to build a successful company. While on a trip in Hokkaido with my girlfriend, I found myself listening absorbedly to Rand Fishkin’s Lost and Founder. Rand Fishkin was the CEO of Moz, a SEO company, and he was sharing his experiences with brutal honesty. One thing he shared was his perspective on taking venture funding. Moz was making $47 million revenue a year by 2017, however as Rand showed in his book, this growth would still not have been sufficient for their venture capital investors. Investors are looking for the 2 or 3 companies out of their portfolio of 20 or so investments that can provide those out-sized returns, in the ball park figure of 3x or more on their capital, and will focus most of their attention on that small handful of companies. This is also known as a power law distribution for the returns on venture capital investments. Venture capitalists are hence looking for hockey stick revenue growth. As Peter Thiel put it, “The biggest secret in venture capital is that the best investment in a successful fund equals or outperforms the entire rest of the fund combined… only invest in companies that have the potential to return the value of the entire fund,” If you want venture funding, you have to be sure that your interests and those of your investors are aligned. When considering what this could mean for my startup, this really drove home for me the fact that the long term viability of the company will likely depend on us playing the long game, to build a well-balanced, profitable growth business, without an expectation of a big exit anytime in the short term. Companies like Mailchimp have done it, and this is a perfectly viable way to build a startup (though not typically the one we hear about most in the media). Jason M. Lemkin did an excellent piece showing that many famous SaaS startups that we think of as up-and-coming, have actually already been around and plugging away for more than 10 years. Which begs the question, how do we define success as a company? To me this means that a startup’s success is directly tied to the quality and longevity of the team they build. There’s a book called “The Culture Code” by Daniel Coyle where he studied great teams like Pixar, the San Antonio Spurs and the U.S. Navy’s SEAL Team Six, and in an article he shared that when Harvard did a study “tracking average culture versus strong culture, strong culture was 782% of net revenue over 10 years.” Seen in this light, this means any person on the team, and anyone we hire, should be seen as a long term investment for the sustainability of the company. Building a successful company for the long haul requires understanding and facilitating the personal career breakthroughs of each person on the team, to “be focusing on how we can help people reach their highest potential and purpose — which will naturally have a positive impact on the bottom line.” So basically, “train people well enough so they can leave, treat them well enough so they don’t want to.” A startup may start out being the brainchild and foolhardy endeavour of the founding team, but for it to go to the next level, it needs to become the collective dream of the team that comes on board. This requires deep reflection into how being part of such a company can truly fulfill each member, to find personal alignment with the company and the opportunities we can have here. And this will need the company to have the processes and environment that allows each of us to really grow over time and achieve the respective personal career breakthroughs we seek for ourselves. TL;DR: If you’re building a startup, plan as you would a marathon over decades, and grow your team culture and skills accordingly on this time frame. Bonus: Read about how Gregg Popovich went about building the most successful sporting franchise in American history to date. In a nutshell, it comes down to building the following team narrative: “You are part of this group. This group is special. I believe you can meet our high standards.”

Published

17 Apr 2019

Building A Startup Without Venture Funding

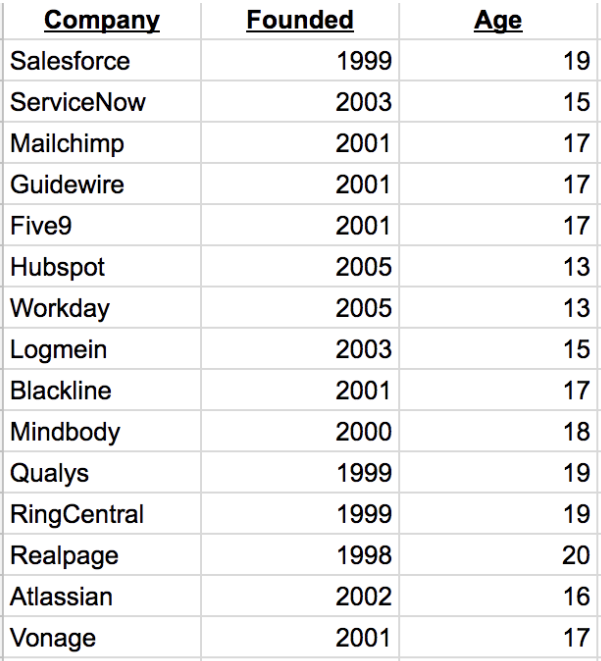

As of 2018, “SaaS companies that are crossing into their third decade in operation — and not slowing down”. (Credit: Jason Lemkin)Growing A Team You Believe In

Some of the young faces building Holistics, with brilliant engineers, product teams and growth hackers hailing from Vietnam, Singapore and Indonesia. The next big tech stories will be coming from this part of the world.A Startup Is The Shared Dream Of The Whole Team, Not Just The Founders

Recent Articles

- Individuation and the Will to Meaning 11 Nov 2024

- Contemplating the Infinite under Finite conditions 2 Jun 2023

- How I Overcame GMAT Critical Reasoning Questions - Reasoning from first premises 29 Oct 2022

- Hello world, from Centroly 25 Jul 2021

- How To Setup A Middleman Blog For Free With GitHub Pages 28 Jun 2020

- Build A Company People Want To Stay With, For Their Entire Careers 24 May 2019

- For SaaS Startup Success, Plan For 10 Years And More 17 Apr 2019

- Present(ing) Futures 1 - The future Singapore economy 4 Apr 2016